XRP Price Prediction: Will It Hit $4 Amid Bullish Momentum?

#XRP

- XRP is trading above its 20-day MA, indicating bullish momentum.

- MACD shows a bearish crossover, suggesting potential short-term consolidation.

- News sentiment is overwhelmingly bullish, with targets up to $10.

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

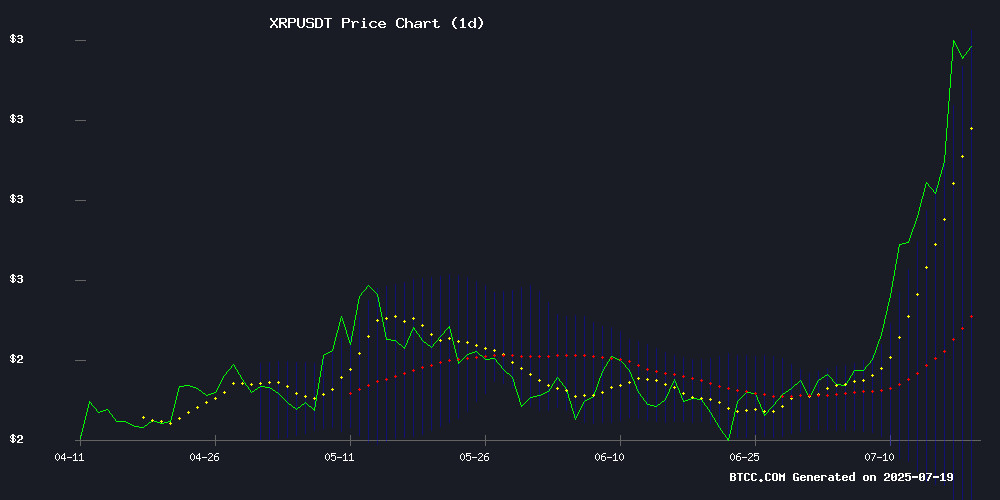

According to BTCC financial analyst Robert, XRP is currently trading at $3.3964, above its 20-day moving average (MA) of $2.6327. The MACD indicator shows a bearish crossover with values at -0.4793 (MACD line), -0.3078 (signal line), and -0.1715 (histogram). Bollinger Bands indicate volatility with the upper band at $3.5005, middle band at $2.6327, and lower band at $1.7649. These technical indicators suggest a potential consolidation phase after the recent rally.

XRP Market Sentiment: Bullish Momentum Amid ETF Speculation

BTCC financial analyst Robert notes that XRP's price surge to $3.45 is fueled by ETF speculation and institutional demand. News headlines highlight bullish predictions, including targets of $6 and $10, though some analysts warn of bearish reversal signals. The overall sentiment remains optimistic, driven by positive momentum and new all-time highs.

Factors Influencing XRP’s Price

Can XRP Hit $1000? Analysts Weigh Mathematical Realities Against Institutional Demand

The debate over XRP's potential to reach $1,000 per token intensifies as analysts clash over market cap mathematics versus institutional adoption scenarios. At current circulating supply levels, such a valuation WOULD require a market capitalization exceeding global GDP—a prospect dismissed by traditional models as mathematically implausible.

Yet some argue institutional demand could rewrite the rules. TokenTax researchers highlight the paradox: while XRP's $58 trillion theoretical cap at $1,000 dwarfs all public companies combined, crypto markets have repeatedly defied conventional valuation frameworks. The asset's future may hinge on whether adoption by financial institutions can override supply constraints.

US Banking Associations Oppose License For Crypto Custody Firms

Five major US banking associations have jointly opposed granting national bank charters to cryptocurrency custody firms, citing insufficient public transparency and questioning whether digital asset custody warrants traditional banking status. The American Bankers Association, Consumer Bankers Association, National Bankers Association, America's Credit Unions, and Independent Community Bankers of America submitted their concerns to the Office of the Comptroller of the Currency regarding applications from Fidelity Digital Assets, Ripple National TR Bank, and other crypto firms.

The banking groups argue that crypto custody services don't constitute fiduciary activities that would justify bank charters, creating regulatory concerns as the industry gains mainstream traction. This resistance emerges paradoxically during a period of growing institutional crypto adoption, highlighted by recent pro-crypto policies from the TRUMP administration.

XRP Price Prediction: After Skyrocketing 24% to New All-Time High This Week – What’s Next?

XRP has surged 24% this week, hitting a multi-year high of $3.27 and pushing its market cap beyond $190 billion for the first time. The rally coincides with the NYSE listing of ProShares Ultra XRP ETF, the first XRP-linked ETF on a major U.S. exchange. Currently trading at $3.25, XRP is just 15% shy of its 2018 all-time high of $3.84.

Perpetual futures open interest reached a record $8.8 billion, reflecting nearly 2.9 billion XRP in Leveraged contracts. Meanwhile, California Governor Gavin Newsom's launch of the California Breakthrough Project at Ripple’s headquarters adds governmental credibility to XRP's utility narrative.

Technical analysis reveals a seven-year symmetrical triangle breakout, with Fibonacci targets pointing to $4.70-$6.48. Historical cycle patterns suggest potential moves toward $22-23. The daily chart shows a 126% rise since April lows, with a decisive breakout above the $2.50-$3.00 resistance zone.

XRP Surges to $3.45 Amid ETF Speculation, $6 Target in Sight

XRP has shattered records with a 25.8% weekly surge, breaching $3.45 as institutional interest intensifies. The rally coincides with mounting anticipation for a July 25 SEC decision on spot ETF approvals—a catalyst analysts believe could propel the token to $6.

ProShares will debut the first XRP futures ETF on July 18, 2025, adding fuel to the bullish momentum. Whale activity underscores the fervor: 2,743 wallets now hold over 1 million XRP each, collectively controlling 47.32 billion tokens.

Technical charts reveal a completed symmetrical triangle formation, reinforcing the $6 price target. The breakout liquidated $31.44 million in short positions, signaling a decisive shift in market sentiment.

XRP Is Climbing to $10: What You Should Do Next?

Ripple (XRP) continues to solidify its position as a leading cryptocurrency, overcoming legal and regulatory hurdles to emerge as a dominant market player. The token's relentless pursuit of global collaborations and integration of traditional banking elements into Web3 finance underscores its long-term potential. Analysts predict a breakout rally, with price targets reaching $10 and beyond.

Egrag Crypto highlights XRP's ambitious trajectory, noting key resistance levels and potential highs of $20-$30. Ripple's strategic moves—including banking license applications and RLUSD adoption—signal transformative shifts in the market. Investors are advised to reinvest wisely as the token approaches these critical thresholds.

XRP Shows Bearish Reversal Signals After Strong Rally

XRP has formed a falling star candlestick pattern on its daily chart, signaling potential short-term bearish reversal after a robust altcoin rally. The pattern—characterized by a long upper wick, small real body, and minimal lower shadow—often marks exhaustion in bullish momentum.

The asset briefly touched $3.70 before facing rejection, settling NEAR $3.49. Despite maintaining week-to-date gains, warning signs emerge as the Relative Strength Index (RSI) breaches 88, entering overbought territory. Historically, such levels precede consolidation or pullbacks.

Recent institutional demand and trading volume initially fueled XRP's outperformance against LAYER 1 peers. However, the falling star formation suggests vulnerability. A confirmed red close with elevated selling volume could trigger a correction toward $3.20 or lower.

Market sentiment appears to be shifting as euphoria fades. Bulls must now defend key psychological levels to prevent deeper retracement. The coming sessions will reveal whether XRP consolidates or surrenders recent gains.

Dave Portnoy Regrets Selling XRP as Token Soars to $3.60 High

Dave Portnoy, the self-proclaimed leader of the XRP army, expressed regret over selling his holdings as the token surged to a 2025 high of $3.60. "I would’ve made millions, and I want to cry," Portnoy said in a video posted on X. His decision to sell at $2.40 followed misinformation about Circle potentially outcompeting Ripple.

XRP's rally marked a 19.61% daily gain, pushing its market capitalization toward $200 billion. Over $68 million in short positions were liquidated in 24 hours, reflecting bullish momentum. The surge coincided with Ripple's application for a U.S. national banking charter, signaling its intent to formalize crypto services under federal oversight.

Best Crypto to Buy Today: Bullish Indicator Could Mean XRP at $3.5 While Unilabs Raises $5.5 Million

XRP's recent surge has reignited investor confidence, with the token gaining 35% over the past month and briefly crossing the $3 mark before settling at $2.80. Analysts suggest a breakout could propel it toward its all-time high of $3.50, despite a temporary cool-off linked to Bitcoin's market-wide correction.

Meanwhile, Unilabs Finance has surpassed $5.5 million in presale funding, positioning itself as a contender for explosive growth. The protocol's sustainable performance is drawing comparisons to early-stage opportunities in decentralized finance.

XRP Surges to New All-Time High Amid Bullish Momentum

XRP has shattered its previous all-time high, soaring past $3 with a near 30% rally in just four days. The cryptocurrency now eyes the $4 level as trading volume surges and bullish momentum intensifies.

Technical indicators suggest the rally may have room to run. The RSI hit 89.8—typically considered overbought—but crypto assets often defy such signals during strong uptrends. With XRP in price discovery mode, traders continue to bid aggressively.

The breakout confirms a longer-term symmetrical triangle pattern that had been forming. This technical development, combined with surging volume, suggests institutional interest may be driving the move.

Will XRP Price Hit 4?

Based on current technical and sentiment analysis, XRP has strong potential to reach $4. The price is already near the upper Bollinger Band ($3.5005), and bullish news sentiment supports further upside. However, the MACD's bearish crossover suggests caution. Key levels to watch:

| Indicator | Value |

|---|---|

| Current Price | $3.3964 |

| 20-Day MA | $2.6327 |

| Upper Bollinger Band | $3.5005 |